Analysis and Conclusion

What are we to make of all this? The most obvious possible explanation for small publishers’ comparatively low ebook sales – even as ebooks account for 29% of the UK market as a whole (Campbell, 2015) – is that they are struggling to come to terms with a market that is more complex and competitive than any they have encountered before.

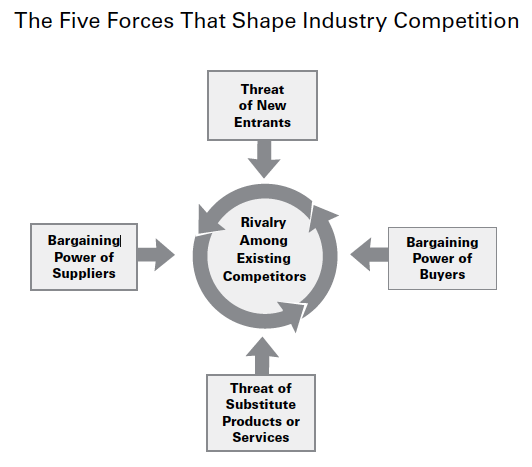

Porter’s ‘five forces’ theory (1979) may be of use in explaining this hypothesis:

Figure 36: Porter's 'Five Forces' model (1979, p. 4).

Twenty or thirty years ago, a small publisher’s situation could have been analysed as follows:

- Rivalry among existing competitors: moderate, as publishers continue to be acquired by conglomerates

- The threat of new entrants: low, due to the high capital costs of entry

- Bargaining power of buyers: low, due to a vibrant and varied bookselling ecosystem

- Threat of substitute products or services: low, as most long-established, ie magazines, newspapers, TV, radio

- Bargaining power of suppliers: weak, as authors have no other effective route to market

If the same analysis is conducted today, the situation looks very different:

- Rivalry among existing competitors: intense, as book sales shrink year on year

- The threat of new entrants: high, due to dramatically lower technical and financial barriers to entry

- Bargaining power of buyers: high, due to Amazon and other large retailers’ dominance of the ebook market

- Threat of substitute products or services: high, with new digital media emerging rapidly, and huge amounts of content available free online

- Bargaining power of suppliers: stronger, as authors can now self-publish easily

Clearly, much of the increase in competition can be traced back to the various technical changes that have taken place in recent years: the advent of desktop publishing, the birth of the internet (and with it Amazon), and the popularisation of ebooks (and hence the rise of self-publishing). To use Clayton Christensen’s phrase, publishing is in the process of being ‘disrupted’ (1997).

How, then, can small publishers respond to this disruption? Clearly, learning to make and sell ebooks puts the small publisher’s scarce time and money at risk of being wasted, but failing to engage with the ebook market at all is also dangerous: as the experience of Spinifex Press shows, your competitors might establish a presence and deny you market share. Publishers should also take care not to outsource too much of what may in future become core business operations, lest they unintentionally strengthen their suppliers’ bargaining power beyond what they can bear.

Above all, small publishers must retain what makes them publishers: their ability to filter and amplify content (Bhaskar, 2013, loc. 187). Each publisher must decide for herself which of the functions which have traditionally been at the core of publishing properly fall within her filtering and amplification efforts. Curating content, editing it, designing the book, creating it, distributing the finished copies or files, and marketing: all are plausible candidates, and the successful small publisher of the future will be the one knowledgeable enough about these multiple domains to make intelligent decisions about which to do when, and how.

Conclusion

Small publishers’ ebook businesses still have room to grow. The data gathered here suggests that smaller publishers are still not taking advantage of the ebook market to the same extent as their larger cousins, and although great strides have been made since Aptara’s last survey in 2012, there remain significant gaps in small publishers’ interest in and knowledge of the subject. As the ebook market stabilises and ebooks take their place as just another format, it is hoped that more small publishers will feel confident enough to learn more about ebooks and take advantage of the extra sales they can offer.

There is much fertile ground for further investigation: future surveys may be able to investigate ebook pricing, marketing, ONIX, and in-book analytics. It would also be enlightening to examine revenue models in further detail: in particular, small publishers’ participation in subscription services and platforms traditionally marketed to self-publishing authors. Ultimately, everyone involved in the production, distribution, sale, and consumption of ebooks stands to gain from better-informed and more creative small presses.